lincoln ne restaurant sales tax

The Nebraska sales tax rate is currently 55. To review the rules in Nebraska visit our state-by-state guide.

History Of Lincoln Nebraska Wikiwand

The Lincoln Sales Tax is collected by the merchant on all qualifying sales made within Lincoln.

. Funds will be removed from your account the next working day. Lincoln is in the following zip codes. As for zip codes there are around 9 of them.

Any company may use this online payment system to pay any of the following Occupation Taxes. The minimum combined 2022 sales tax rate for Lincoln Nebraska is 55. Lincoln NE Sales Tax Rate Lincoln NE Sales Tax Rate The current total local sales tax rate in Lincoln NE is 7250.

The 2018 United States Supreme Court decision in South Dakota v. While Nebraskas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. This page describes the taxability of food and meals in Nebraska including catering and grocery food.

What is the sales tax rate in Lincoln Nebraska. The calculation of the invoice is shown below. This page describes the taxability of food and meals in Nebraska including catering and grocery food.

THE FEE TO ASSIGNA TAX SALE IS 20 PER CERTIFICATE AND IS NON-REFUNDABLE. Lincoln County is located in Nebraska and contains around 8 cities towns and other locations. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022.

NE Sales Tax ID. To learn more see a full list of taxable and tax-exempt items in Nebraska. The December 2020 total local sales tax rate was also 7250.

Nebraska has recent rate changes Thu Jul 01 2021. The minimum combined 2022 sales tax rate for Lincoln Nebraska is 725. The Lincoln County sales tax rate is.

There is no applicable county tax or special tax. The average cumulative sales tax rate in Lincoln Nebraska is 688. Lincolns new occupational tax begins Jan.

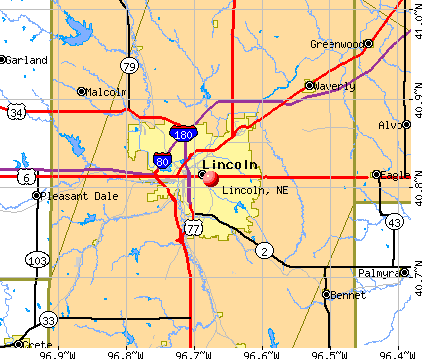

Within Lincoln there are around 28 zip codes with the most populous zip code being 68516. Has impacted many state nexus laws and sales tax collection requirements. Lincoln NE Sales Tax Rate.

Did South Dakota v. The most populous location in Lincoln County Nebraska is North Platte. At httpwwwrevenuenebraskagovinfooccupation_taxhtml Example Restaurant Bill A customer purchases a meal at a restaurant in a city with a 2 occupation tax on restaurants.

950 sales tax 10950 total. 025 lower than the maximum sales tax in NE. This is the total of state county and city sales tax rates.

In Lincoln another 15 percent or one and a. The Nebraska state sales tax rate is currently. 3-2007 Supersedes 6-371-1999 Rev.

YOU CAN NOT ASSIGN A TAX SALE IMMEDIATELY AFTER THE SALE WE NEED TIME TO PROCESS THE PAPER WORK. The average cumulative sales tax rate between all of them is 583. Meal 5000 Occupation Tax 2 100remit to City Subtotal 5100 Sales Tax 725 State 55 and City 175.

The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax. Nebraska NE Sales Tax Rates by City The state sales tax rate in Nebraska is 5500. The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax.

Lincoln is located within Lancaster County Nebraska. As far as sales tax goes the zip code with the. _____ Are you reporting for multiple locations.

What is the sales tax rate in Lincoln Nebraska. For tax rates in other cities see Nebraska sales taxes by city and county. This includes the sales tax rates on the state county city and special levels.

68501 68502 68503. Select the Nebraska city from the list of popular cities below to see its current sales tax rate. Nebraska and local option sales tax by bars taverns and restaurants.

THE FEE TO APPLYFOR A TAX DEED IS 20 PER DEED AND IS NON-REFUNDABLE. Taxable RestaurantBar Gross Receipts Total of line 1 and line 2 4RestaurantBar Occupation Tax Due 2 of Line 3 5Interest. Sales Tax Breakdown Lincoln Details Lincoln NE is in Lancaster County.

There will be a 4 percent occupational tax on hotel rooms rental cars and a 2 percent tax on meals and drinks in restaurants and bars. Meal 5000 Occupation Tax 2 100remit to City Subtotal 5100 Sales Tax 725 State 55 and City 175. RestaurantBar Gross Receipts Subject to tax per Lincoln Municipal Chapter 330 2Adjustments to RestaurantBar Gross Receipts.

You can print a 725 sales tax table here. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. The Nebraska sales tax rate is currently 55.

The Lincoln sales tax rate is 175. THE FEE TO PURCHASE A TAX SALE IS 20 PER CERTIFICATE AND IS NON-REFUNDABLE. Lincoln ne restaurant sales tax Wednesday June 1 2022 The average cumulative sales tax rate in Lincoln Nebraska is 688.

As far as sales tax goes the zip code with the. With local taxes the total sales tax rate is between 5500 and 8000. It is not intended to answer all questions which may arise but is intended to enable a person to become familiar with the sales tax provisions affecting bars taverns and restaurants.

Businesses for Sale in 400 categories and 240 countries. The state sales tax rate stands at 55 percent or around five and a half cents for ever dollar spent. A full list of these can be found below.

While Nebraskas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. What is Omaha NE sales tax. If you have any questions please call the Lincoln City Treasurer Monday thru Friday from 800 am to 430 pm at 402 441-7457 or use our email.

This is the total of state county and city sales tax rates. 2 6029 Old Farm Cir Lincoln NE 68512. Payments will be processed on the first working day after the 25th of the month.

Lincoln in Nebraska has a tax rate of 725 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Lincoln totaling 175. The County sales tax rate is 0. Automating sales tax compliance can.

The Nebraska state sales and use tax rate is 55 055. To learn more see a full list of taxable and tax-exempt items in Nebraska.

Lost Restaurants Of Lincoln Nebraska A Dining Critic Takes On The Delicious Past Dining Journalstar Com

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Misty S Third Location Is A Prime One Dining Journalstar Com

Lincoln Ne Lnk Great American Stations

Dining Out In Lincoln Ollie Hobbes Concept Devised With Family In Mind Dining Journalstar Com

Embassy Suites Lincoln Lincoln Ne 1040 P 68508

Pinned September 5th 1 Long Islands At Applebees Restaurants Thecouponsapp Shopping Coupons Long Island Iced Tea Blue Long Island

Hampton Inn Suites Lincoln Northeast I 80 Lincoln Ne 7343 Husker Cir 68504

History Of Lincoln Nebraska Wikiwand

Nebraska Sales Tax Small Business Guide Truic

Ann Post Partner Rembolt Ludtke Llp Linkedin

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Carvers Orchard Farm Market Courageous Christian Father Farm Market Farm Carver

Lost Restaurants Of Lincoln Nebraska A Dining Critic Takes On The Delicious Past Dining Journalstar Com

Country Club Of Lincoln Ne Posted By Kenneth Hart Architect House Styles Red Barn Country Clubs

Pandemic Will End Nebraska Club S 66 Year Run In Lincoln Dining Journalstar Com

Sesostris Shrine Lincoln Ne Sesostrisshrine Twitter

Lincoln Ne Gov City Of Lincoln And Lancaster County Coronavirus Covid 19 Business Resources

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders